A place for the descendants of Helen McFarland Woodbridge to gather, since 1933. This is a family website and most features require a login to access.

Our History

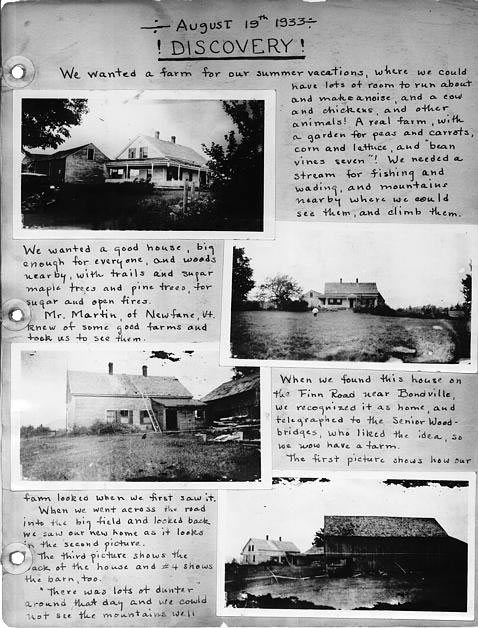

Wind Hill Farm was purchased in 1933 by Joseph Lester Woodbridge as a summer place for Helen McFarland Woodbridge and Donald Woodbridge to take their family.

Their five children enjoyed summers in Vermont and subsequently brought their families to the farm later for summers, weekends and holidays. Many of us continue the tradition to the extent our busy lives allow.

The farm was left in trust from Helen to her children, so that it could continue to serve as a place for family for future generations. Over the years, her descendants have maintained and funded the farm, in the hope that future generations can continue to create memories.

Our Present

Today, that trust has been changed into a family corporation, Woodbridge Farm Inc, who's purpose is to own and maintain the farm indefinitely. All corporate shareholders are direct descendants of Helen McFarland Woodbridge.

Currently, Woodbridge Farm Inc has 24,000 shares of common stock, split between members of the family. Decisions are made by voting shares to elect a Board of Directors to manage the farm. The board appoints a slate of corporate officers to carry out the farm's business.

Shareholders

Family

Members

Years